21. Besides the distinguishing features which were noticed in Sampelly, there was another ground which weighed in the judgment of this Court. The Court adverted to the decision in HMT Watches v. MA Habida [(2015) 11 SCC 776 ] to hold that whether the cheques were given as security constitutes the defense of the accused and is a matter of trial. The extract from the decision in HMT Watches which is cited in the decision in Indus Airways is thus:

“10. Whether the cheques were given as security or not, or whether there was outstanding liability or not is a question of fact which could have been determined only by the trial court after recording evidence of the parties. In our opinion, the High Court should not have expressed its view on the disputed questions of fact in a petition under Section 482 of the Code of Criminal Procedure, to come to a conclusion that the offence is not made out. The High Court has erred in law in going into the factual aspects of the matter which were not admitted between the parties.

xxx

26. The object of the NI Act is to enhance the acceptability of cheques and inculcate faith in the efficiency of negotiable instruments for transaction of business. The purpose of the provision would become otiose if the provision is interpreted to exclude cases where debt is incurred after the drawing of the cheque but before its encashment. In Indus Airways, advance payments were made but since the purchase agreement was cancelled, there was no occasion of incurring any debt. The true purpose of Section 138 would not be fulfilled, if ‘debt or other liability’ is interpreted to include only a debt that exists as on the date of drawing of the cheque. Moreover, Parliament has used the expression ‘debt or other liability’. The expression “or other liability’ must have a meaning of its own, the legislature having used two distinct phrases. The expression ‘or other liability’ has a content which is broader than ‘a debt’ and cannot be equated with the latter. In the present case, the cheque was issued in close proximity with the commencement of power supply. The issuance of the cheque in the context of a commercial transaction must be understood in the context of the business dealings. The issuance of the cheque was followed close on its heels by the supply of power. To hold that the cheque was not issued in the context of a liability which was being assumed by the company to pay for the dues towards power supplied would be to produce an outcome at odds with the business dealings. If the company were to fail to provide a satisfactory LC and yet consume power, the cheques were capable of being presented for the purpose of meeting the outstanding dues.

xxx

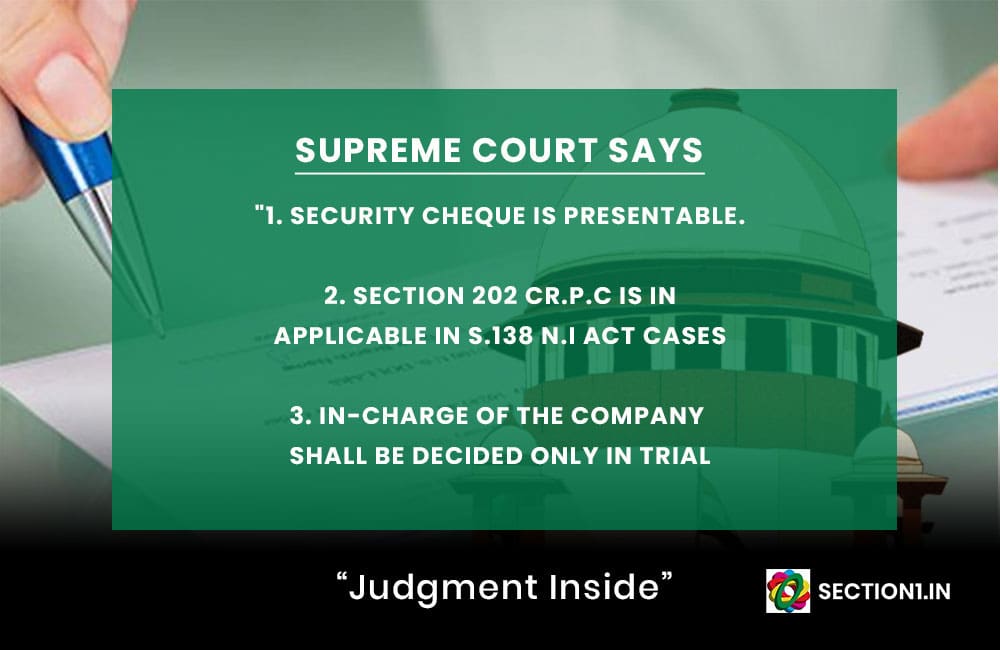

CHEQUE TOWARDS SECURITY CANNOT BE DECIDED U/S 482 Cr.P.C: 29. The order of this Court in Womb Laboratories holds that the issue as to whether the cheques were given by way of security is a matter of defence. This line of reasoning in Womb Laboratories is on the same plane as the observations in HMT Watches, where it was held that whether a set of cheques has been given towards security or otherwise or whether there was an outstanding liability is a question of fact which has to be determined at the trial on the basis of evidence. The rationale for this is that a disputed question of this nature cannot be resolved in proceedings under Section 482 CrPC, absent evidence to be recorded at the trial.

CHEQUE AS SECURITY – CAN BE PRESENTED FOR ENCASHMENT: 30. The submission which has been urged on behalf of the appellants, however, is that the fact that the cheques in the present case have been issued as a security is not in dispute since it stands admitted from the pleading of the second respondent in the suit instituted before the High Court of Madras. The legal requirement which Section 138 embodies is that a cheque must be drawn by a person for the payment of money to another “for the discharge, in whole or in part, of any debt or other liability’. A cheque may be issued to facilitate a commercial transaction between the parties. Where, acting upon the underlying purpose, a commercial arrangement between the parties has fructified, as in the present case by the supply of electricity under a PSA, the presentation of the cheque upon the failure of the buyer to pay is a consequence which would be within the contemplation of the drawer. The cheque, in other words, would in such an instance mature for presentation and, in substance and in effect, is towards a legally enforceable debt or liability. This precisely is the situation in the present case which would negate the submissions of the appellants.

SECTION U/S 202 CR.P.C – JURISDICTION NOT AN ISSUE: 32. Under Sub-Section (1) of Section 202, a Magistrate upon the receipt of a complaint of an offence of which he/she is authorized to take cognizance is empowered to postpone the issuance of process against the accused and either (i) enquire into the case; or (ii) direct an investigation to be made by a police officer or by such other person as he thinks fit. The purpose of postponing the issuance of process for the purposes of an enquiry or an investigation is to determine whether or not there is sufficient ground for proceeding. However, it is mandatory for the Magistrate to do so in a case where the accused is residing at a place beyond the area in which the Magistrate exercises jurisdiction. The accused persons in the present case reside at Aurangabad while the complaint under Section 138 was filed before the Magistrate in Mundra. The argument of the appellants is that in these circumstances, the Magistrate was duty bound to postpone the issuance of process and to either enquire into the case himself or to direct an investigation either by a police officer or by some other person. Section 203 stipulates that if the Magistrate is of the opinion on considering the statement on oath, if any, of the complainant and of the witnesses, and the result of the enquiry or investigation if any under Section 202 that there is no sufficient ground for proceeding, he shall dismiss the complaint recording briefly his reasons for doing so. The requirement of recording reasons which is specifically incorporated in Section 203 does not find place in Section 202. Section 204 which deals with the issuance of process stipulates that if in the opinion of the Magistrate taking cognizance of an offence, there is sufficient ground for proceeding, he may issue (a) in a summons case, a summons for attendance of the accused; (b) in a warrant case, a warrant or if he thinks fit a summons for the appearance of the accused. These proceedings have been interpreted in several judgments of this Court. For the purpose of the present case, some of them form the subject matter of the submissions by the appellants and the second respondent.

…

38. Section 145 of the NI Act provides that evidence of the complainant may be given by him on affidavit, which shall be read in evidence in an inquiry, trial or other proceeding notwithstanding anything contained in the CrPC. The Constitution Bench held that Section 145 has been inserted in the Act, with effect from 2003 with the laudable object of speeding up trials in complaints filed under Section 138. Hence, the Court noted that if the evidence of the complainant may be given by him on affidavit, there is no reason for insisting on the evidence of the witnesses to be taken on oath. Consequently, it was held that Section 202(2) CrPC is inapplicable to complaints under Section 138 in respect of the examination of witnesses on oath. The Court held that the evidence of witnesses on behalf of the complainant shall be permitted on affidavit. If the Magistrate holds an inquiry himself, it is not compulsory that he should examine witnesses and in suitable cases the Magistrate can examine documents to be satisfied that there are sufficient grounds for proceeding under Section 202.

xxx

IN-CHARGE OF THE COMPANY – SHALL BE DECIDED ONLY IN TRIAL: 44. The test to determine if the Managing Director or a Director must be charged for the offence committed by the Company is to determine if the conditions in Section 141 of the NI Act have been fulfilled i.e., whether the individual was in-charge of and responsible for the affairs of the company during the commission of the offence. However, the determination of whether the conditions stipulated in Section 141 of the MMDR Act have been fulfilled is a matter of trial. There are sufficient averments in the complaint to raise a prima facie case against them. It is only at the trial that they could take recourse to the proviso to Section 141 and not at the stage of issuance of process.

PARTY: Sunil Todi & Ors vs. State of Gujarat & Anr – Criminal Appeal No.1446 of 2021- December 03, 2021.

Source: https://main.sci.gov.in/supremecourt/2019/24425/24425_2019_34_1501_31794_Judgement_03-Dec-2021.pdf

URL: